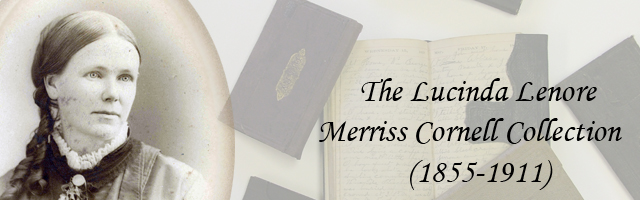

The Lucinda Lenore Merriss Cornell Collection: Ephemera

Files

Download Full Text (11.8 MB)

Date Range

1930-1935

Materials/Description of item

A tax document, specifically the Taxpayer's Copy of Treasurer's Form No. 16-A, titled "UNDERTAKING TO PAY FULL PRINCIPAL AMOUNT OF DELINQUENT TAXES AND ASSESSMENTS, LESS PENALTIES, INTEREST AND OTHER CHARGES IN SIX ANNUAL INSTALLMENTS." This document was used to keep track of the late taxes and additional penalties that needed paid by Abbie G. Cornell et al. on a Westerville property as of December 5, 1933.

Keywords

Cornell Collection, Financial Records

Disciplines

Cultural History | History | United States History

Recommended Citation

Cornell, Abbie Geneva, "Form for Delinquent Taxes on State St. Property, Abbie. G. Cornell, December, 1933" (1933). The Lucinda Lenore Merriss Cornell Collection: Ephemera. 366.

https://digitalcommons.otterbein.edu/cornell_ephemera/366

Notes on the item

"Abbie G. Cornell being the owner of real estate situated in the T.D. of Blendon Westerville Corp., described as follows: Lot 5 20.736 Acres, Parcel 513, State St., which real estate stands charged on the tax lists and duplicates of Franklin County, Ohio, with taxes and assessments which became duplicate at or prior to the August settlement in the year 1892 in the principal sum of $40.00, less penalties, interest and other charges, DO HEREBY ELECT AND AGREE to pay the full principal amount of such taxes and assessments so delinquent in six (6) annual installments..." -- from document